Untraded potential: What 81% of European smartphones at home reveal about the market

At Retech Days Europe 2025, one topic stood out among industry insiders: the slow but promising evolution of the European smartphone trade-in market. While the sector lags behind global benchmarks, new data and expert insights suggest a path forward for boosting adoption and trust. Europe trails behind, but the gap can be closed Compared to…

At Retech Days Europe 2025, one topic stood out among industry insiders: the slow but promising evolution of the European smartphone trade-in market. While the sector lags behind global benchmarks, new data and expert insights suggest a path forward for boosting adoption and trust.

Europe trails behind, but the gap can be closed

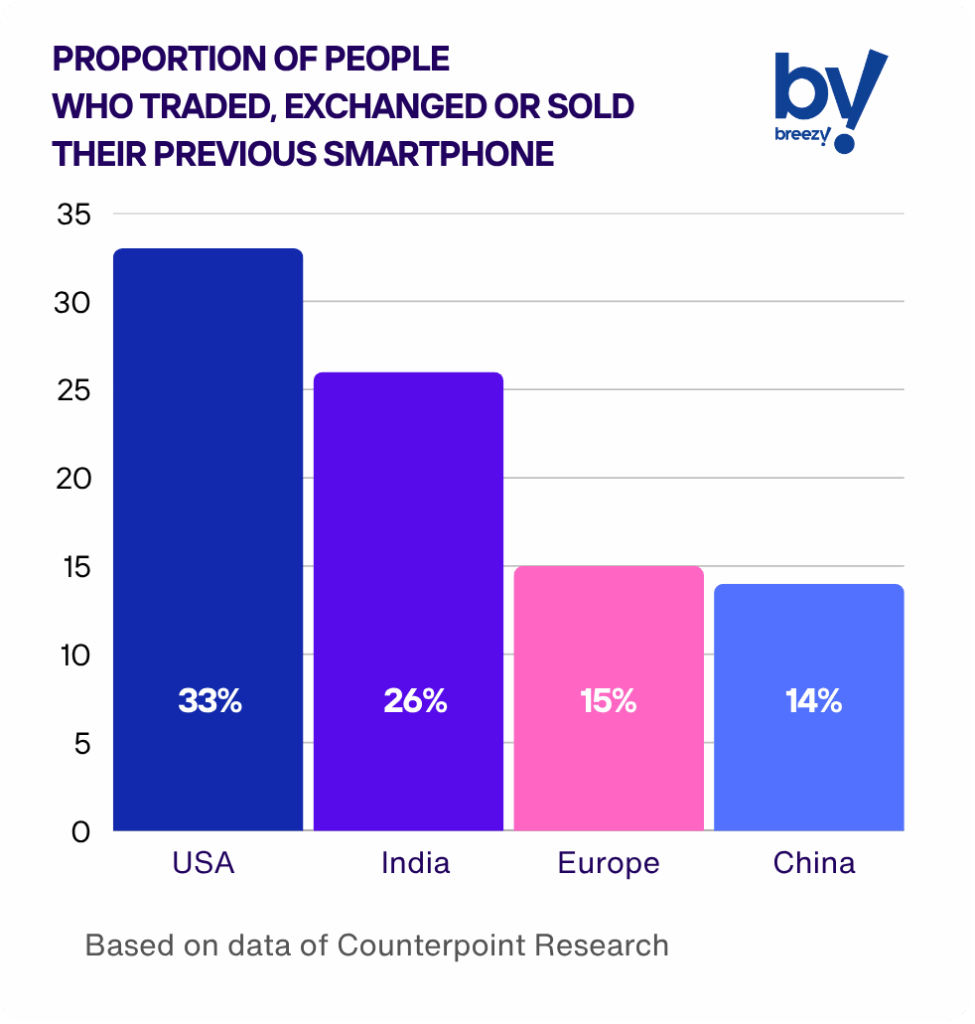

Compared to the U.S., where 33% of consumers engage in trade-in programs, and India at 26%, Europe remains far behind — only 15% of users currently trade in their smartphones.

Surprisingly, this is nearly equal to the rate in China (14%), a country similarly known for holding onto devices.

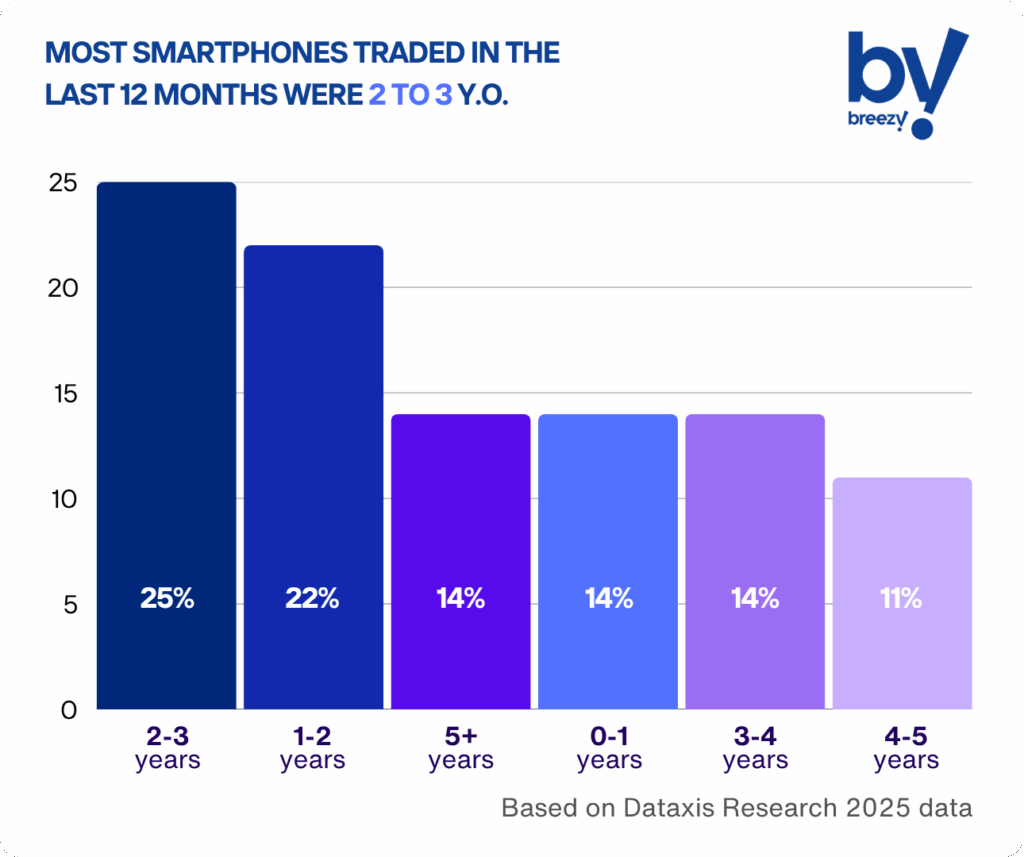

In Germany, most traded-in smartphones are 2–3 years old, indicating a relatively moderate replacement cycle.

Notably, 22% of German users upgrade every year — a segment ripe for trade-in engagement.

What customers do with their phones

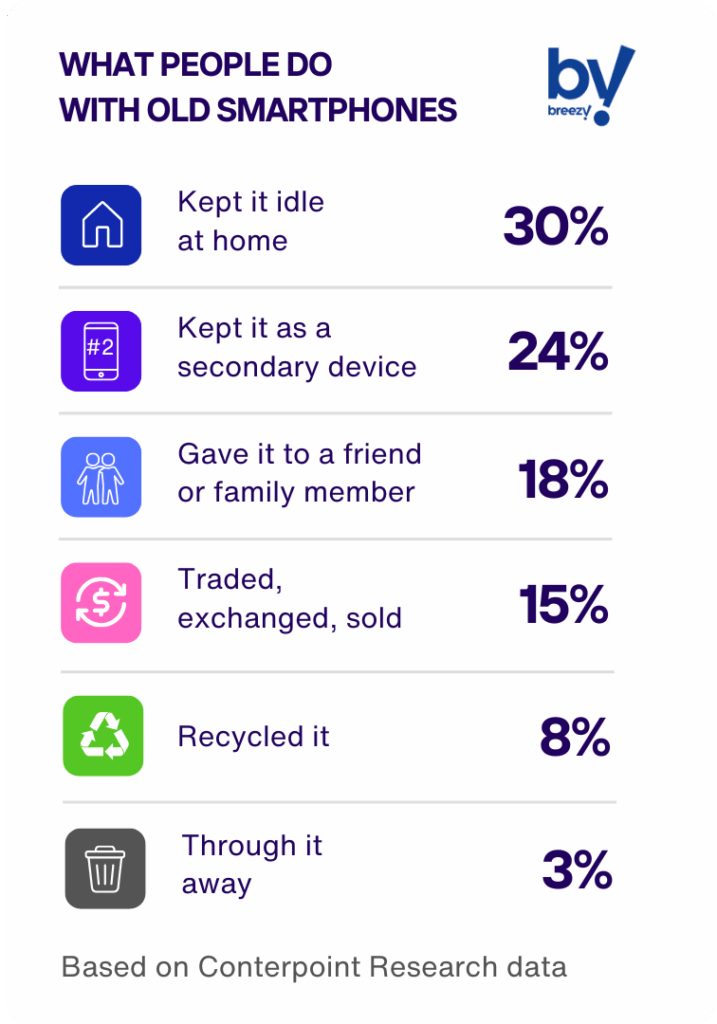

So, what are Europeans doing with their old phones instead?

So, what are Europeans doing with their old phones instead?

- 30% leave them idle at home

- 24% keep them as backup devices

- 18% give them away to family or friends

- A small portion opt to recycle them — a sustainable, but less common, choice.

How Trade-In evolves

The panel discussion at Retech Days Europe between Andrii Kosar (Breezy), Owain Griffiths (GRADE MOBILE) and Sander Matthezing (Remarketed Group) tackled the core points. It’s not just awareness, but trust, transparency and price that define successful trade-in programs.

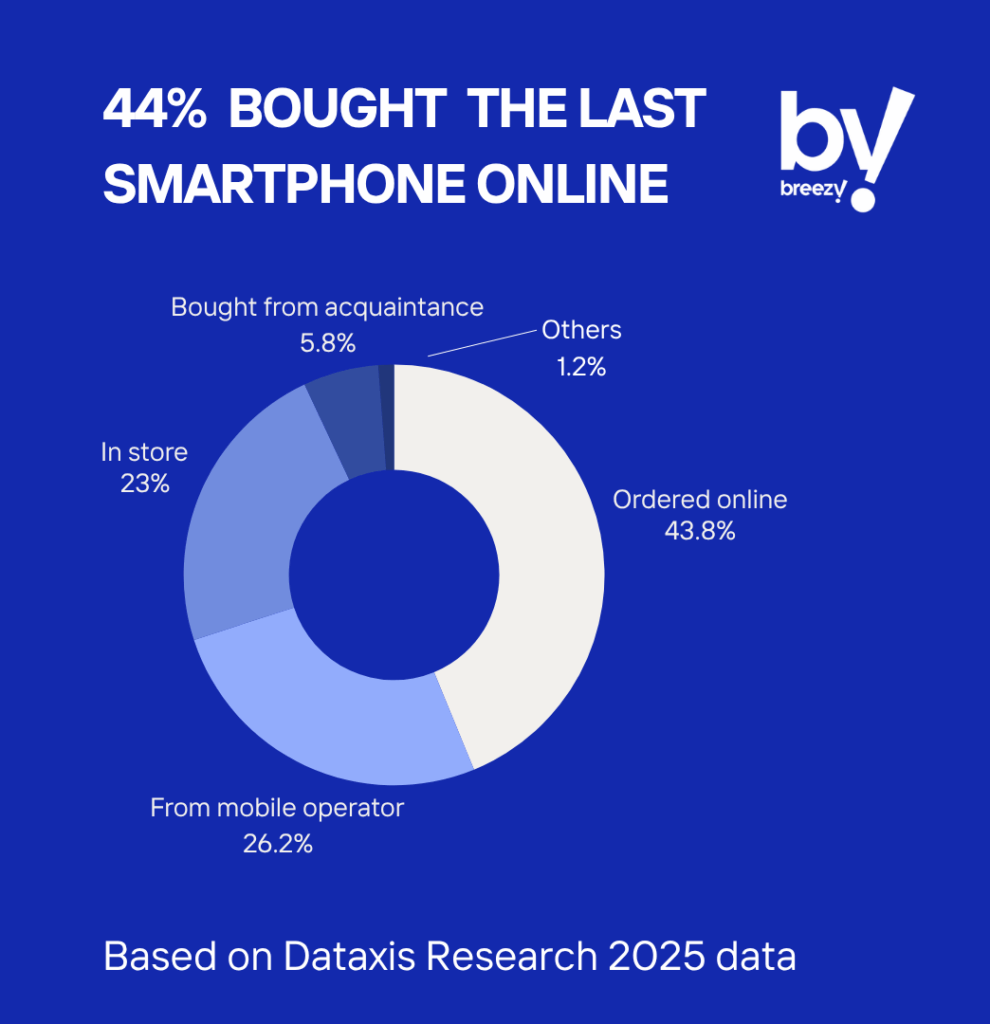

44% of smartphones in Europe are now purchased online, making trade-in online solutions not just helpful, but essential.

Only 23% buy in-store and 26% through mobile operators.

The online channel is where the future of trade-in must be built.

Demographics matter

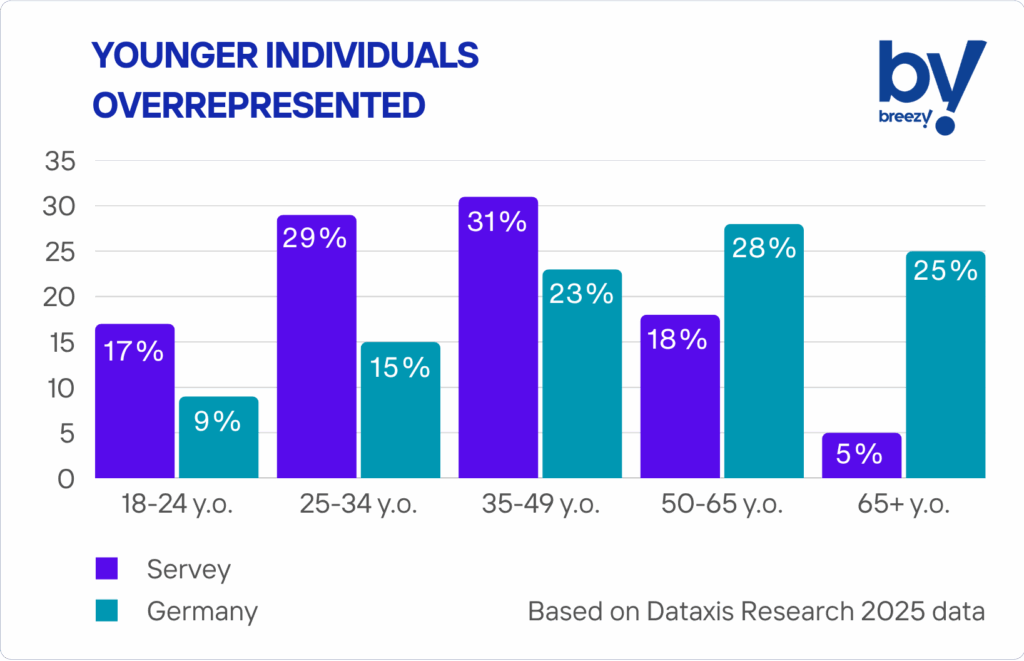

According to Dataxis Research:

- 46% of trade-in users are aged 18–34

- Only 23% are over 50

This reflects a generational divide in values. As Paulo Almeida (Worten) pointed out, “Young people are driven by sustainability, while older consumers care most about price.” Successful strategies must cater to both mindsets.

Transparency drives satisfaction

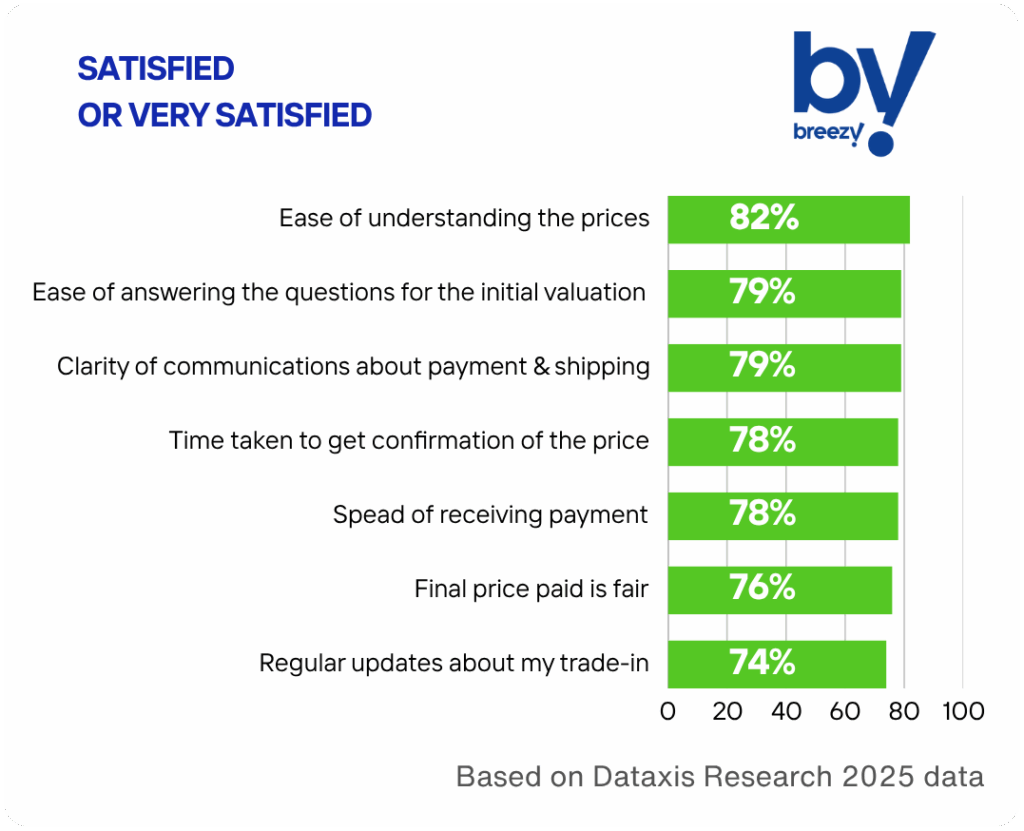

What do customers value most in a trade-in program?

According to Dataxis research:

- 82% appreciate transparent pricing

- 79% value clarity during the initial valuation

- 74% want regular updates on trade-in progress

Andrii Kosar, CEO of Breezy, commented:

“At Breezy, we believe that a great trade-in experience comes down to 3 key pillars: it should be fast, easy, and offer maximum residual value with minimal effort. Whether it happens online or in-store, the trade-in should feel seamless and transparent.Also important to make it visible. We put the trade-in value directly on product pages, and instantly subtracting it from the cost of the new device. It’s not just about convenience — it’s also about making sustainability more affordable.

Most importantly, customers should get what they expect. That’s why we’ve built a smart, fast process: snap a few photos, get a final price in under 3 minutes, and we commit to that price. No surprises.This balance of value and simplicity is what makes trade-in work.”

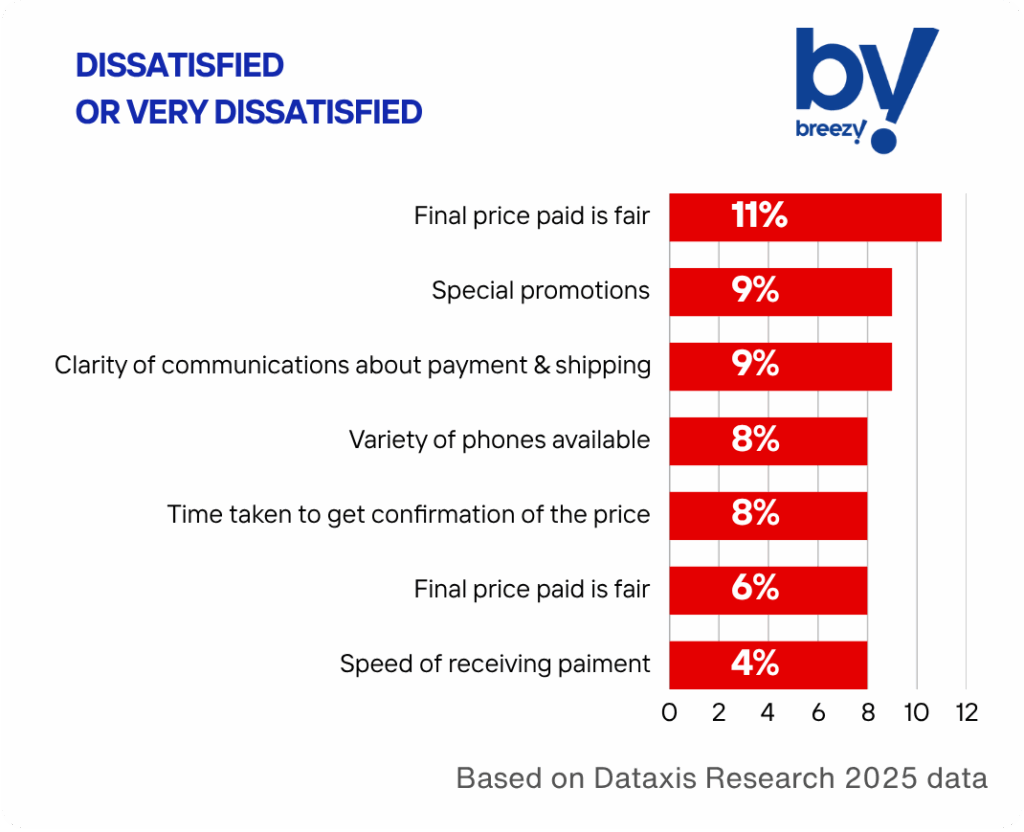

Where Trade-In fails

The biggest source of dissatisfaction? Pricing.

- 11% cite discrepancies between initial and final offers

- 9% complain about special promotions and unclear payment terms

- 8% note delays in confirming prices or counteroffers

As Andrii Kosar added,

“Trade-in should never feel like guesswork. At Breezy, we believe that transparent, data-backed evaluation builds real trust. That’s why price shouldn’t come out of thin air — customers deserve to understand exactly how their device is valued.

We’ve built a smart system that blends AI with human expertise to analyze customer-submitted photos and deliver fast, fair results. This approach minimizes errors from both customers and staff, and gets pricing right the first time.

Operationally, it’s a game changer: we’ve brought discrepancy levels down to nearly zero. The real win? We reinvest the savings from these improvements straight into higher residual values for customers. Better accuracy, better value, better experience.”

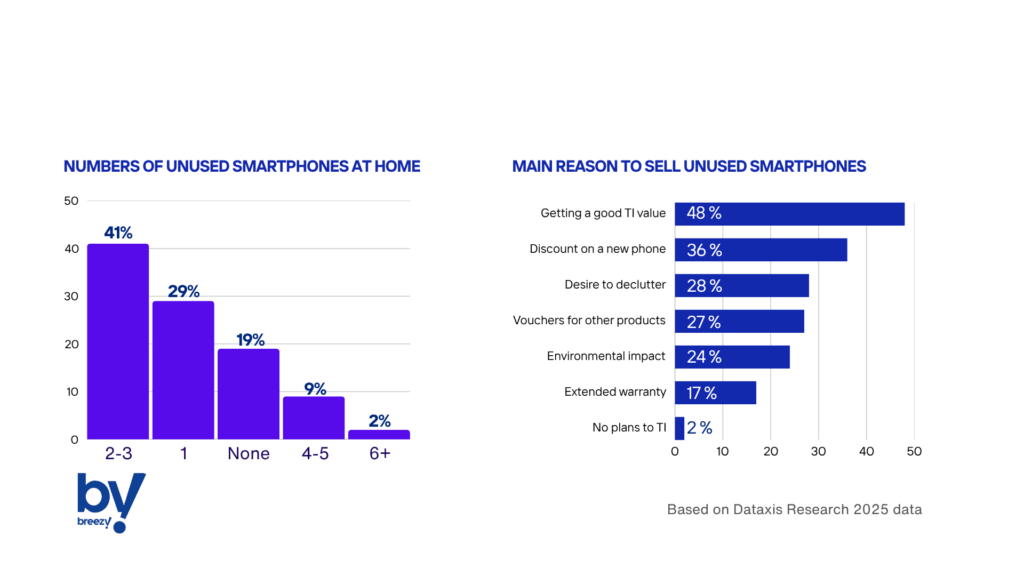

The opportunity is sitting at home

Data shows 81% of respondents keep unused smartphones at home, and 48% would sell if the price was right.

That’s a sleeping market of tens of millions of devices — and an opportunity for trade-in programs to awaken it with more effective messaging and user-centric tools.

The formula for growth

“Clear process + diagnostics = transparency. Transparency increases trust, and trust fuels trade-in growth.”

— Andrii Kosar, Breezy

As European consumers slowly warm to the idea of trading in their tech, the brands that focus on clarity, fairness, and customer empowerment will define the next wave of growth in this untapped market.

International

International  Ukraine

Ukraine  Poland

Poland  Georgia

Georgia  Kazakhstan

Kazakhstan  Cyprus

Cyprus  Azerbaijan

Azerbaijan  Moldova

Moldova