The secondary market as the new center of gravity: Insights from Circular Markets London 2026

The secondary mobile device market is no longer a supporting channel — it is becoming a structural driver of revenue, retention, and long-term margin stability across Europe. At Circular Markets London 2026, Breezy CEO Andrii Kosar and Trade-in Product Manager Jan Mazur joined industry leaders to discuss the shifts redefining the market: affordability replacing sustainability…

The secondary mobile device market is no longer a supporting channel — it is becoming a structural driver of revenue, retention, and long-term margin stability across Europe.

At Circular Markets London 2026, Breezy CEO Andrii Kosar and Trade-in Product Manager Jan Mazur joined industry leaders to discuss the shifts redefining the market: affordability replacing sustainability as the primary purchase trigger, AI transforming pricing and grading, trust becoming the key condition for scale, and Samsung’s announcement on expanding access to original spare parts — a move closely aligned with right-to-repair initiatives and the growing role of independent refurbishment across Europe.

We gathered key insights from the discussions — and from Andrii and Jan’s perspective — to outline what these changes mean for operators, retailers, and trade-in providers, and where the next wave of growth will emerge.

Insight 1. Affordability is the new №1 driver

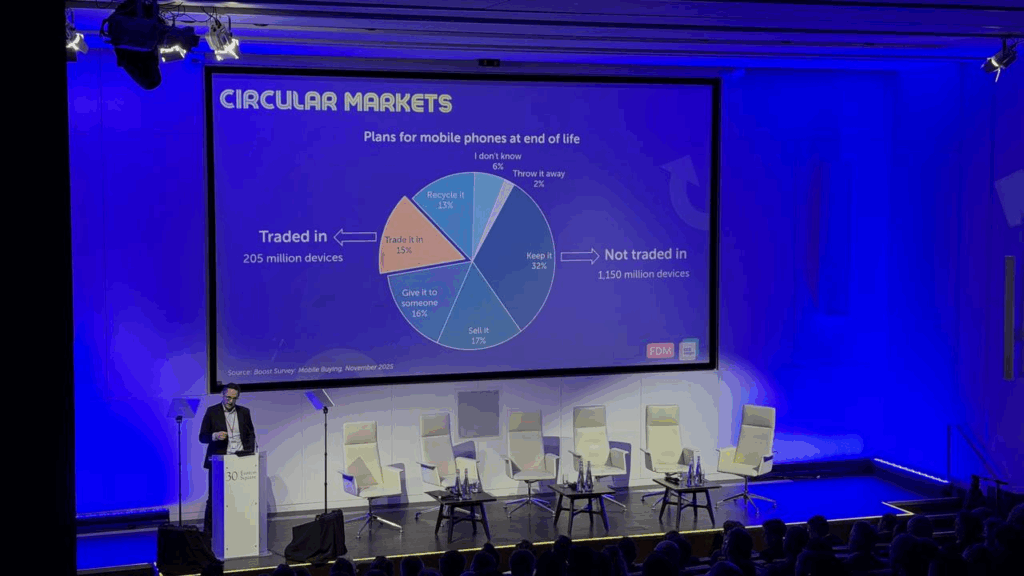

Five years ago, we talked about Trade-in to save the planet. Today, we talk about it to save the budget. In an environment of global inflation, affordability has become the #1 driver.

● The price magic: A one-year-old iPhone loses up to 50% of its value. Trade-in is the only legitimate way to get a premium brand at a “mid-range” price point.

● The life-time value factor: If an operator keeps a customer in the ecosystem for more than 3 years, the probability of them staying for 8 years increases significantly.

● More frequent upgrades: Lucrative exchange programs force customers to buy a new smartphone an average of 8 months earlier than they had planned.

Sustainable consumption no longer sells as an abstract idea. It sells as a simple and financially attractive scenario.

○ Trade-in as retention: Programs offering up to $800 credit for an old device lock customers into the ecosystem for 2–3 years.

○ Repair first: Same Unit Repair is on average $60 cheaper than replacing a device with a refurbished one and significantly increases trust.

○ Faster upgrades: Attractive trade-in offers accelerate smartphone upgrades by an average of eight months.

○ Higher basket size: “Real cash” for an old device increases willingness to buy more expensive models and accessories.

○ Loyalty: 86% of customers return after a positive trade-in experience.

○ Smartphone as a service: Device-as-a-Service models create a predictable flow of high-quality used devices.

○ Instant gratification: Doorstep trade-in and contract-based circular models are replacing the “ship and wait” approach.

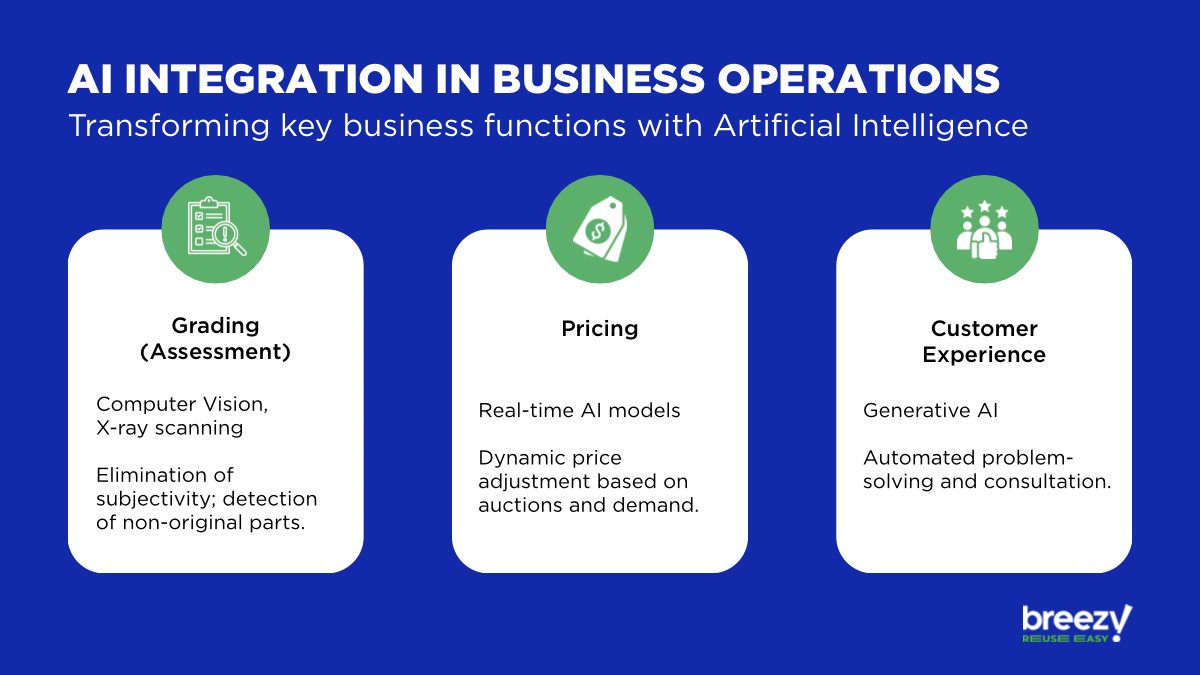

“We replaced the subjective ‘I think so’ assessment with AI algorithms in 2024. That enables us to provide an instant discount during trade-in – whether online or in-store,” said Jan Mazur.

Insight 2. Barriers on the way to a 25% attachment rate

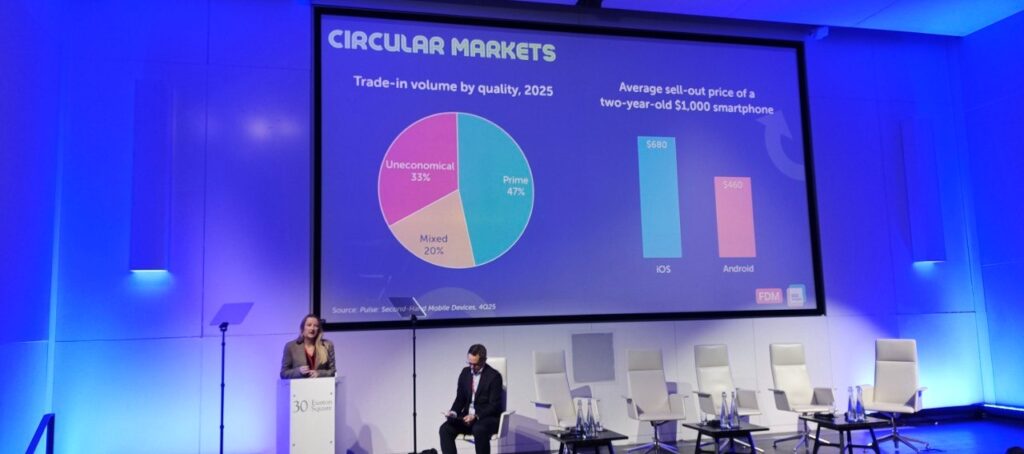

A study of 3,000 consumers revealed a significant gap between awareness and actual behaviour. While 87% of consumers know they can trade in an old phone, only 60% receive a real offer when buying a new device, and just 44% complete the transaction.

The research highlighted that the decision to trade in isn’t blocked by a single issue, but by a “stack” of obstacles: on average, each consumer faces 2.1 simultaneous barriers:

○ Price perception vs. reality: Customers typically expect $260–280 for a device. If the offer falls below their internal “threshold of effort,” the device stays home.

○ Data privacy concerns: Especially relevant for older customers (over 30% vs. 20% among younger users).

○ Complex data transfer: Devices with 1 TB of storage may require up to three hours for data migration in-store.

As a result, around 60% of phones are kept at home, losing about 2% of their value every month.

Solution

Overcoming these barriers requires less new technology and more management commitment. AI-based pricing with a guaranteed offer reduces staff hesitation and shortens transaction time. A clear financial trigger at the $260–270 level turns a phone in a drawer into a depreciating asset. Hybrid models allow customers to transfer data at home, while a top-down priority makes trade-in a strategic pillar rather than an optional add-on. This is how a 25% attachment rate becomes achievable.

“At Breezy, we have already turned Trade-in barriers into growth drivers. As Forbes Ukraine notes, our implementation of AI-driven evaluation has reduced error rates to <1%, allowing customers to instantly save up to 60% on new gadgets. Thanks to our omnichannel model—unique even for Europe—our partners are boosting sales by 20% by integrating Trade-in directly into the checkout flow. While millions of devices lose value in drawers, Breezy is scaling, making official tech more accessible than ‘gray’ imports,” noted Andrii Kosar, CEO of Breezy

Insight 3. The formula for scale: automation and trust

Front-end automation removes subjectivity and reduces the process to 3–5 minutes. Comprehensive data and device passports create a transparent device history. Trust, however, rests on three pillars: warranties, battery certification, and verified authenticity of parts. Without these, scaling the secondary market is impossible.

Device passport & Transparent data: Full device history ensures transparency and prepares devices for circular reuse.

“For Breezy, transparency is the top priority. We want customers to see the full state of a device even before unboxing it. Every package features a QR code leading to a Device Passport—a digital certificate with a 55-point diagnostic history and high-resolution photos of that specific unit. We don’t just sell refurbished tech; we sell trust. By providing an official warranty and full history for every gadget, we ensure the secondary market has a transparent and sustainable future,” commented Andrii Kosar, CEO of Breezy.

Trust drives the circular market builds it on three pillars:

○ Warranty: 70% of consumers see a formal guarantee as essential.

○ Battery certification: 65% need proof of healthy batteries, the most critical weak point in refurbished devices.

○ Authentic components: Customers want to be sure parts are genuine, not cheap copies.

Boosting trust: Samsung provides authentic parts for the secondary market

A key highlight of the conference was the announcement by Richard Chang (Head of Samsung UK & Ireland), underscoring Samsung’s continued commitment to circularity. As part of its broader sustainability program, Samsung is expanding access to authentic spare parts and official diagnostic tools. By making these resources more widely available, the company strengthens its support for repair, refurbishment, and the extended lifecycle of devices — reinforcing its role in building a more transparent and trusted secondary market.

Insight 4. AI and robotics as the business nervous system

By 2026, AI has become a commercial necessity. X-ray scanning, computer vision, and dynamic pricing protect margins where a 1–2% error can cost millions. At the same time, around 50% of devices still require manual repair, making hybrid models the most effective approach.

Hyper-personalisation: AI predicts customer needs and offers relevant products, such as insurance linked to the real repair cost of a specific model.

Top 5 trends for 2026

● Vertical Integration: Shortening the supply chain to maximise residual value.

Samsung has created a global Galaxy Value Innovation Team. The company is moving from a passive observer to a “value engine,” managing the full lifecycle of each device — from the first sale to the second owner.

● Forward Trade-in: Customers know the guaranteed buyback price two years in advance.

● Subscription models (Protect & Upgrade): Trade-in, insurance, and financing combined into one monthly payment.

Breezy has long been implementing this trend into business through its SmartAlu program. This innovative subscription model allows iSpace users in Kazakhstan to acquire the latest iPhone with minimal monthly payments and a seamless upgrade path.

● Short Loop: OEMs and operators keep devices within their own ecosystems.

● Smartphone as a Service: A shift to subscription models where the value of the old device simply reduces your monthly payment.

The future of the ecosystem: what partners must deliver

Building a truly circular economy requires OEM openness to original spare parts, bank willingness to finance refurbished devices, and simpler diagnostics. Trade-in is no longer about giving a phone a second life. It is about creating a new consumption model where affordability, trust, and technology define the future of the market.

“Attending Circular Markets 2026 turned out to be exactly as insightful as I expected, I had the chance to hear expert opinions and explore a huge amount of data on the current state of the European pre‑owned device market. What stood out to me is how closely this aligns with our own view: the potential is enormous, and millions of customers are simply waiting for attractive, convenient offers that will motivate them to trade in their old devices,” noted Jan Mazur, Trade-in product manager at Breezy.

International

International  Ukraine

Ukraine  Poland

Poland  Georgia

Georgia  Kazakhstan

Kazakhstan  Cyprus

Cyprus  Azerbaijan

Azerbaijan  Moldova

Moldova