Is the MENA region becoming the next leader in the circular economy?

The MENA region stands on the brink of a technological shift: users want to upgrade their devices more often while spending less; businesses are exploring new monetization models; and governments are increasingly focused on building a circular economy. At Retech Days MENA, held Oct. 1 in Dubai, one message was clear — the “second life”…

The MENA region stands on the brink of a technological shift: users want to upgrade their devices more often while spending less; businesses are exploring new monetization models; and governments are increasingly focused on building a circular economy. At Retech Days MENA, held Oct. 1 in Dubai, one message was clear — the “second life” tech market is no longer a niche. It’s becoming a strategic priority for the industry.

The market is growing rapidly but faces familiar challenges: the need for unified standards, regulatory support, transparent pricing, user convenience, and affordability as a key driver.

We’ve gathered the main trends that resonated both on stage and in private discussions throughout the event.

Trade-in in MENA: from experiment to market infrastructure

The trade-in service is already taking root in the region, with both local providers and international companies — many of which also operate in Europe — actively expanding their presence. However, trade-in still accounts for a relatively small share of all transactions, and overall customer awareness remains low. The main growth drivers include transparent valuation, convenience, process speed, omnichannel access, and close cooperation among OEMs, distributors, retailers, and telecom operators.

Transparency: the core currency of trust

Customers increasingly choose trade-in when they clearly understand how their device’s value is determined. On average, consumers tend to overestimate their devices by about 30%, which often leads to disappointment during the final evaluation. When pricing is well-explained and feedback is built into every step, users feel they’re getting a fair deal — regardless of the actual price.

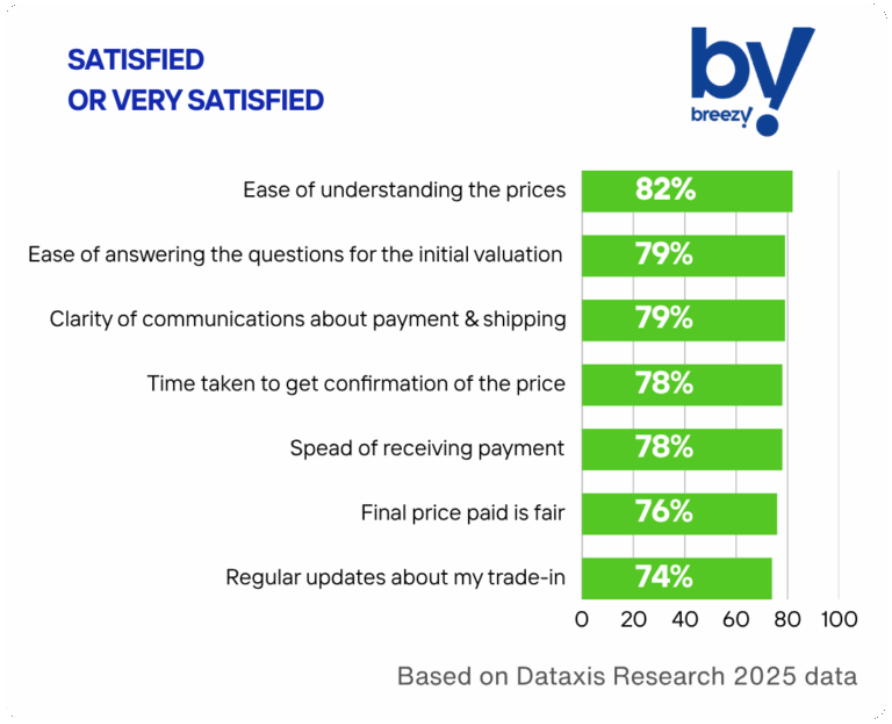

In this regard, the MENA region mirrors the European market. According to Dataxis, 82% of European users value transparent pricing, 79% appreciate clarity in the pre-assessment process, and 74% expect regular updates throughout the transaction.

Breezy’s solution ensures maximum transparency for users through precise, automated device evaluation tools.

ll Breezy partners have access to the best diagnostic technologies — including Apple’s authorised hardware diagnostic tool, which provides the most accurate assessment in under a minute. In addition, our AI-powered visual diagnostic tool delivers instant value during online evaluation while minimizing potential errors. This level of transparency gives customers confidence that they’re receiving a fair price.

Speed = conversion: trade-in should take minutes, not days

In Europe, 81% of smartphones remain unused at home — and according to Retech Days participants, the percentage in MENA is likely even higher.

Give users a simple app: they register the device, and we send a courier. Even if the phone’s value is zero, the client still receives an incentive. That’s how you drive engagement.

The main way to boost trade-in adoption is to make the process effortless, fast, and habitual — ensuring the same high-quality experience both in-store and online.

For us, a positive trade-in means creating maximum value with minimal effort — both for our partners and for end users. That’s exactly how Breezy’s trade-in solution works. Our turnkey system seamlessly integrates into the existing infrastructure of retailers and mobile operators, enabling their customers to purchase devices more affordably, without any friction. Inventory management, logistics, staff training and motivation, a mobile app for in-store sales teams, and an intuitive widget for online users — all backed by 24/7 support and wide customization — are available to every Breezy partner.

Breezy’s trade-in program operates omnichannel — meaning device valuation, reward processing, and logistics are handled seamlessly across both online and offline formats. This makes trade-in a part of the everyday customer experience, not just a one-time campaign.

The growth triangle: OEM + telco + retail

Conference participants agreed that telecom operators are becoming key drivers of market development. They combine user trust, broad reach, and access to millions of customers.

As one event attendee noted, “Operators play a crucial role — they can make trade-in part of subscription services.”

Joint programs involving OEMs and retailers help accelerate device replacement cycles and establish a more stable exchange ecosystem.

Such partnerships have already proven effective in other regions: collaborative programs between operators, vendors, and marketplaces allow customers to upgrade their devices every 12–18 months through trade-in benefits.

By integrating trade-in directly into our partners’ sales systems, we make it a natural part of the purchase journey.

Breezy’s experience with over 50 telecom operators, retailers, marketplaces, and major electronics manufacturers demonstrates how this approach benefits every party involved. It makes devices more accessible, boosts conversion, and turns trade-in into an organic element of the sales ecosystem.

Why cutting VAT matters more than any technology

The secondary device market in MENA still lacks cohesive legislation, unified standards, and tax incentives. Yet extending the lifespan of electronics supports the region’s economy, reduces import dependency, and mitigates environmental impact.

Governments must make sustainability part of procurement — otherwise vendors may lose tenders if they don’t comply.

Reducing VAT on used electronics, as done in Turkey, would greatly improve the competitiveness of official trade-in channels compared to the gray market. No technology or automation could deliver such a fast and powerful impact.

Refurbished in MENA: a market without a framework

The refurbished electronics sector in MENA remains largely unsystematic. It is dominated by small local players selling imported products, with no unified grading standards or operating models. However, the demand for refurbished devices is rising — signaling a strong potential for growth.

Grading transparency: the first step toward mass trust

The absence of consistent grading standards makes customers cautious — they want to be sure they’re not buying a “black box.” Building trust begins with providing clear, detailed information about each device’s condition.

For instance, every refurbished device from Breezy comes with a device inspection passport accessible via a QR code on the packaging. It provides detailed information about that specific gadget — battery capacity, part authenticity, test results, and high-resolution photos. This allows buyers to know exactly what they’re getting before even opening the box.

Physical retail as the primary trust channel

The global shift toward online shopping doesn’t fully apply to refurbished electronics in the MENA region. Skepticism about product quality drives many consumers to prefer buying in physical retail stores instead.

“Customers want to hold the device in their hands. They’re used to trusting small stores where they personally know the seller,” noted one of the Retech Days participants.

Breezy has long adopted an omnichannel approach to selling refurbished devices. E-commerce platforms enable fast and efficient scaling among users already familiar with the product and brand, while physical stores remain more effective for first-time buyers who prefer a hands-on experience before making a purchase.

Local production = quality + margin + speed

Most refurbished devices sold in the MENA region are imported from various suppliers and graded according to inconsistent standards. To scale sustainably, the market needs to develop local refurbishment and grading facilities.

Breezy’s experience shows that shifting from manual grading and upgrading to automated production lines ensures consistency, reduces costs, and supports scalable growth.

B2B + B2C = resilience and scale

Market players are increasingly adopting hybrid models — combining sales to individual consumers with corporate partnerships. This approach provides stable volumes, flexible demand management, and reduced dependency on retail market fluctuations.

Retech Days MENA demonstrated that the region is moving fast. More companies and operators now see device reuse not as a niche, but as a new economy — where transparency becomes the currency, and sustainability evolves into a long-term strategy.

Europe may have walked this path earlier, but MENA is progressing faster — with ready-made technologies, digitally savvy users, and a growing recognition that a device’s “second life” can be just as profitable as its first.

International

International  Ukraine

Ukraine  Poland

Poland  Georgia

Georgia  Kazakhstan

Kazakhstan  Cyprus

Cyprus  Azerbaijan

Azerbaijan  Moldova

Moldova