Beyond the hype: real data on Europe’s refurbished tech landscape

The refurbished tech industry gathered in Berlin for Retech Days Europe 2025, the leading event for leaders, innovators, and disruptors in the circular electronics economy. As a proud participant, Breezy joined key voices from across the continent to exchange insights and tackle the challenges shaping the future of secondary electronics. Here are the key takeaways….

The refurbished tech industry gathered in Berlin for Retech Days Europe 2025, the leading event for leaders, innovators, and disruptors in the circular electronics economy. As a proud participant, Breezy joined key voices from across the continent to exchange insights and tackle the challenges shaping the future of secondary electronics.

Here are the key takeaways.

The primary market: flatlining with subtle shifts

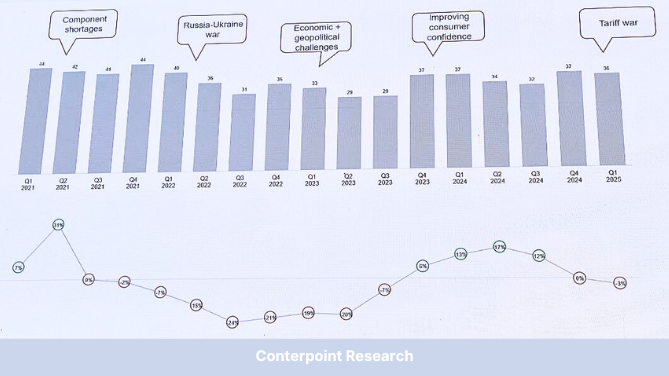

The European market for new smartphones is showing signs of stagnation. As Jan Stryjak, Associated Director of Conterpoint Research, shared, 36 million devices were sold in Q1 2025 —3% fewer than in the previous quarter and slightly lower than a year earlier.

Why?— While Europe is not directly affected by the U.S.-China tariff standoff, the global trade tensions are dampening consumer sentiment and slowing purchasing decisions.

At the same time, Android smartphones are gaining ground:

- Samsung reclaimed the top position in Q1 2025,

- Honor and Motorola continue to grow,

- Apple, though steady, holds 31% of the market.

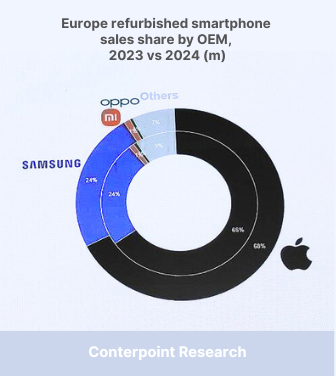

Interestingly, while Android dominates new sales, Apple leads in the refurbished space.

The secondary market: resilient but realistic growth

In 2024, Apple’s share of the refurbished smartphone market increased to 68%, up 2% points YoY.

Consumers continue to seek the combination of reliability, brand recognition, and software support that Apple devices offer.

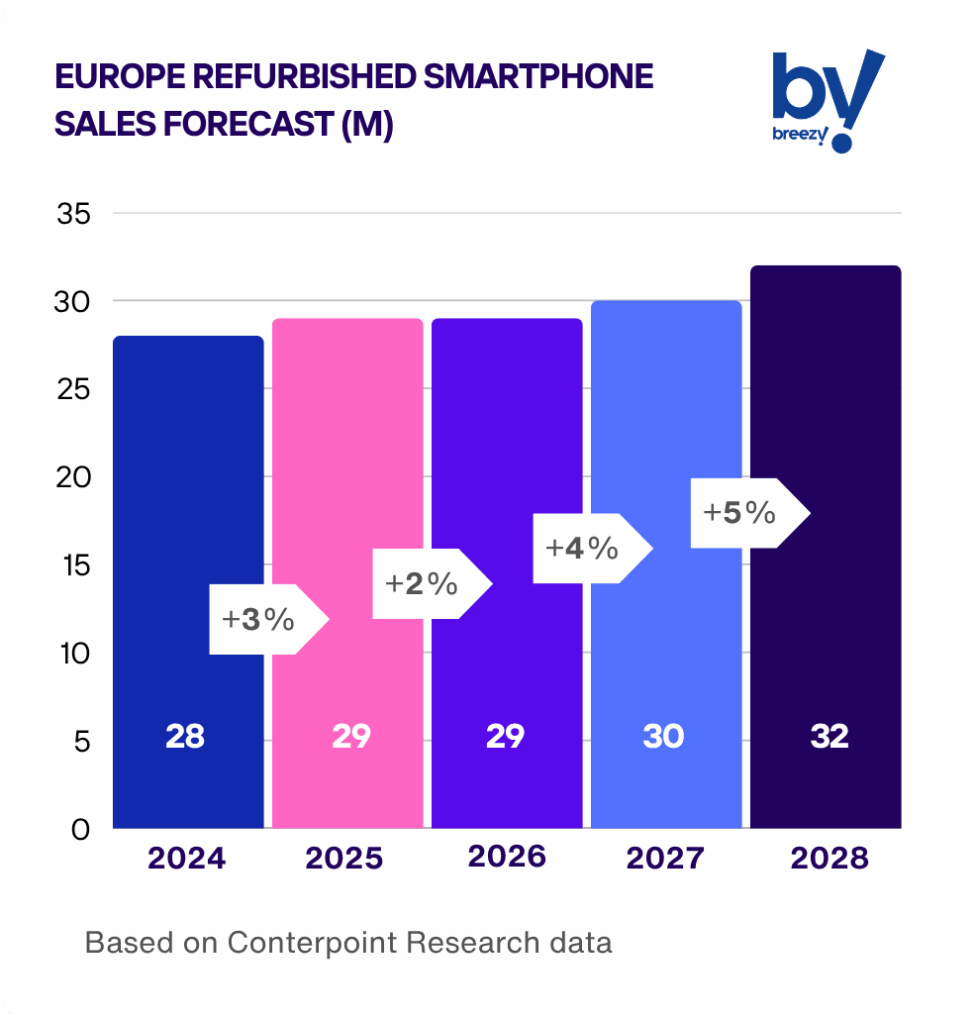

The refurbished market is expected to grow, with projections reaching 32 million units by 2028.

However, growth will be slower than previously forecast, as the industry stabilizes post-pandemic and absorbs current global uncertainty.

Consumer behavior: price still rules, sustainability follows

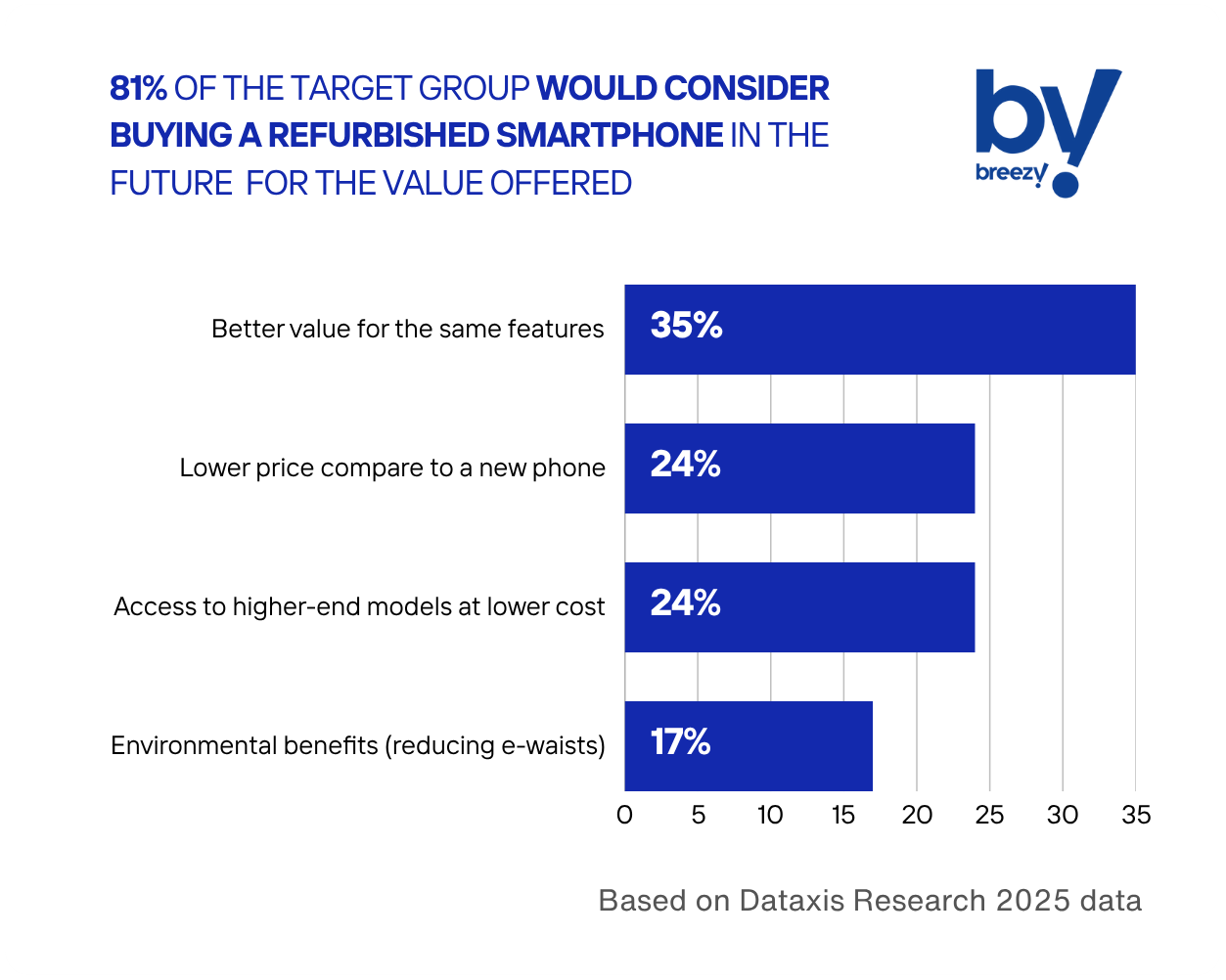

According to Dataxis Research 2025, European consumers remain cautious:

- 68% of German customers surveyed said their last phone was brand new,

- 25% chose certified refurbished,

- A promising 81% would consider refurbished in the future—primarily for the value.

Interestingly, environmental motivations are growing, but still secondary: only 17% cite sustainability as their main reason to buy refurbished. Or, as we use to say in Breezy, ‘economy first, ecology next’.

As Michael Schmelcher, Managing Director at GEWA in Switzerland, pointed out: “For Windows laptop buyers, price remains the top priority.”

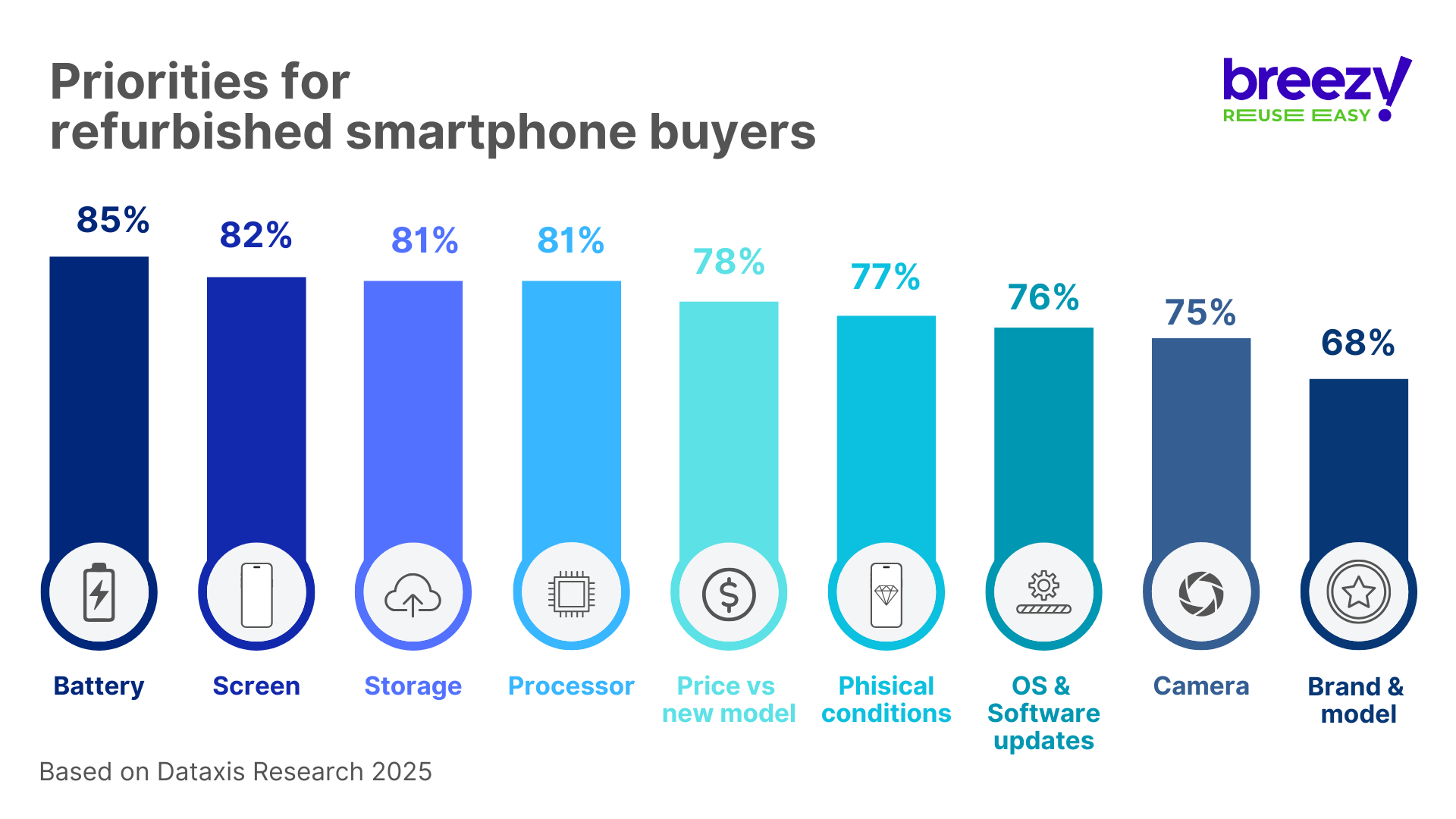

Other priorities for refurbished buyers

Secondary market penetration: room for growth

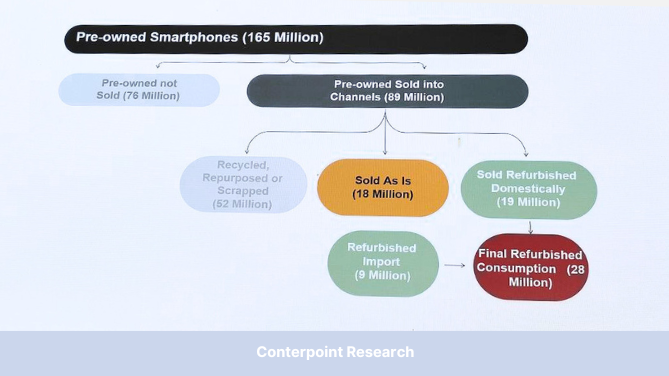

Only 17% of the 165 million pre-owned smartphones in Europe were sold as refurbished to end-users—a rate that has improved slightly (+4% to Q3 2024) but remains a huge opportunity. In absolute terms, the number of refurbished devices sold has plateaued (27 mln vs 28 mln).

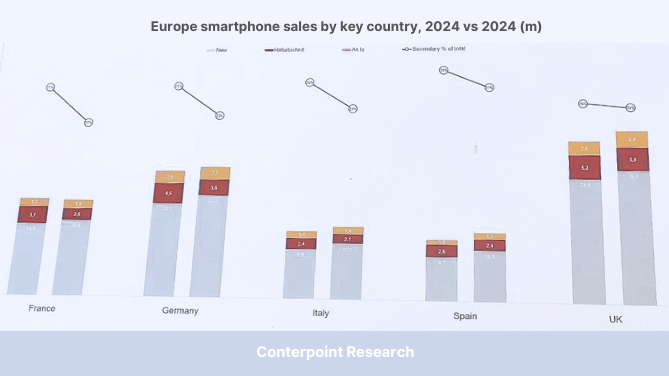

The market share of refurbished smartphones is decreasing across most countries:

- France saw the sharpest drop at -5% YoY,

- UK remains more stable at -1%.

This reflects a need for better consumer education, clearer value propositions, and improved access to trade-in and buyback solutions.

What’s next? Trade-In and the road ahead

Trade-in continues to be one of the most effective gateways into the refurbished economy—but that deserves a post of its own.

Stay tuned for further update, where we’ll dive into:

- The role of trade-in in reshaping the market,

- Key levers for trust and user experience,

- How to bridge the gap between linear and circular retail.

Until then, one thing is clear: the refurbished market is not a trend yet—it’s a transformation.

International

International  Ukraine

Ukraine  Poland

Poland  Georgia

Georgia  Kazakhstan

Kazakhstan  Cyprus

Cyprus  Azerbaijan

Azerbaijan  Moldova

Moldova