MobileDisrupt 2025: The market has matured. What’s next?

By Andrii Kosar, CEO of Breezy How does Amazon scale Trade-In without its own retail network? What do India, Africa, and Central & Eastern Europe have in common? And how did it come to pass that one in every seven phones sold in 2024 was used? These are just some of the questions discussed at…

By Andrii Kosar, CEO of Breezy

How does Amazon scale Trade-In without its own retail network? What do India, Africa, and Central & Eastern Europe have in common? And how did it come to pass that one in every seven phones sold in 2024 was used?

These are just some of the questions discussed at the recent MobileDisrupt conference in Florida, where hundreds of C-level leaders gathered to discuss who will set the rules for the reuse technology industry of tomorrow.

The secondary market is no longer secondary

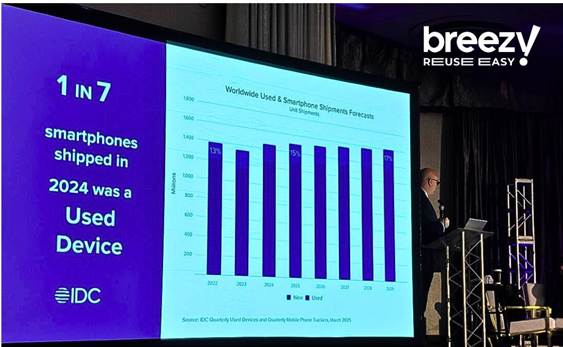

According to IDC, reused technology is now the third-largest segment in global smartphone sales—after Apple and Samsung. In 2024, the secondary market reached $75 billion, growing at a CAGR of 10.4%. Some 208 million used phones were sold last year alone.

Today, one in seven phones sold globally is not new. The average smartphone passes through 2–3 users in its lifetime—clear evidence of a consumer shift toward rational, circular consumption.

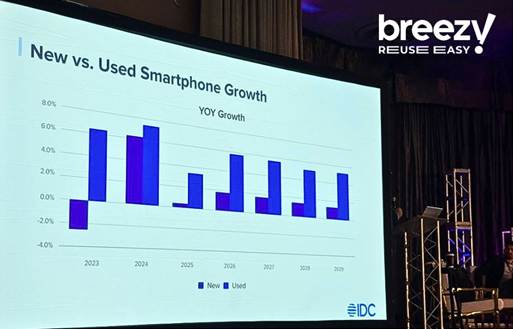

At the same time, the secondary market is not just growing—it is actively eating into the new device segment. New smartphones now lose up to 45% of their value in the first six months, nearly twice as fast as just 3–4 years ago. The reasons are well-known: oversupply, a lack of technological breakthroughs, and declining upgrade motivation.

In contrast, refurbished devices offer greater financial and operational stability:

- More liquid resale value

- Longer price plateaus for 1.5–2-year-old models

- More predictable margins—especially with vertical integration

Grading: Time to speak a common language

Another key takeaway from the conference is that the industry is finally ready to unify device grading standards. CTIA’s updated Wireless Device Grading Criteria v5.0 represents the first real attempt at creating a universally understood language of device condition—useful to everyone from logistics coordinators to end customers.

Why does this matter?

- It removes the subjectivity of A/B/C grading

- It reduces returns and disputes

- It builds trust across supply chains

- It enables large-scale B2B transactions between regions

At Breezy, we adhere to rigorous grading standards that closely align with the CTIA framework. We actively support the adoption of unified grading criteria and encourage all players—from local resellers to global operators—to do the same. Transparency, measurability, and consistency are the foundations of a mature industry.

The market is hot—but the rules of the game are changing

I kept hearing the same refrains in the corridors and panel sessions—and I realised: Breezy is already doing what others are calling ‘the future of the industry

Here’s what’s shifting:

Speed is no longer about logistics—it’s about decisions

Today, winners are not those who ship fastest, but those who evaluate, route, and decide quickest. Whether it’s repair, resale, or warehouse storage, “72 hours from evaluation to shelf” is the new norm.

AI is not a plan—it’s operational

Companies that aren’t already testing automated grading are falling behind. The optimal model is hybrid: AI handles 80–85% of cases, with human input for edge cases. This is the model we use at Breezy—and it delivers speed, accuracy, and objectivity.

Transparency is the new currency of trust

“No photo, no report—no deal.” That phrase became something of a manifesto at the conference. Users want to:

- See how their device was assessed

- Understand the reason behind a grade

- Trust the platform

Today, a digital “device passport”—with high-res photos and test results—is a requirement in both B2B and B2C deals.

The geography of growth: India, Africa, and CEE

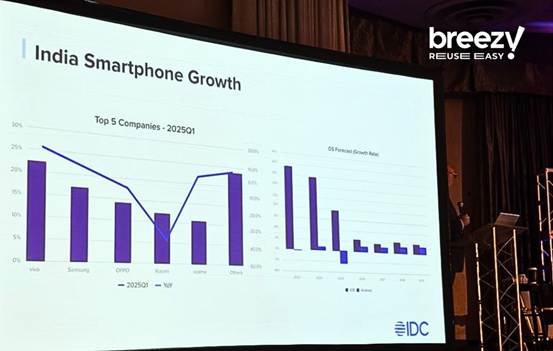

Some of the most compelling sessions weren’t about tech, but territory. Emerging markets are gaining ground:

India

- 70%+ of transactions occur online without physical inspection

- Algorithms are trusted more than in Europe

- Simplicity is king: “Give me the price, take the device, pay me fast.”

Africa

- Huge potential for local partnerships

- Key barriers: logistics and finance

- Where trust and last-mile service work, conversions rival Europe

Breezy has seen this firsthand in South Africa, where we launched operations in 2025.

CEE / Ukraine / Poland

- High demand for refurbished devices

- Customers value local warranties and clear processes

- Trade-In is now a core channel, not just an “add-on”

How Samsung created the architecture of the circular model

Samsung has shown that buying back used phones is only half the battle. To succeed, a circular model must:

- Automate evaluation

- Accelerate routing (repair, recycle, resell)

- Integrate with production cycles

- Prioritise speed-to-market over ownership of every process

In the U.S., Samsung has partnered with local providers—an approach mirrored by many Breezy partners across Europe, Asia, and Africa.

The last mile of Trade-In: Flexibility beats infrastructure

One striking takeaway: customers want choice in how to return their devices. Amazon, despite lacking its own retail chaine, offers Trade-In through partner networks—logistics firms, retailers, and couriers.

To scale Trade-In, companies must:

- Unlink from physical stores

- Offer multiple hand-in options

- Focus on process and user experience, not control of locations

At Breezy, our omnichannel Trade-In allows instant online evaluation and discount application. Customers can return their old device via courier, in-store, or by post. And we’re constantly expanding our partner network to make the process as convenient as possible—because in the end, our biggest competitor isn’t another platform. It’s inertia.

”I leave MobileDisrupt 2025 with one overriding impression: the market is mature. Margins may be tighter, competition fiercer—but opportunities are greater than ever.

The secondary market is no longer just “another channel.” It’s the foundation of a new mobile economy. How we approach data, speed, transparency, and AI will determine whether we become part of the future—or just part of the statistics”, highlighted Andrii Kosar.

International

International  Ukraine

Ukraine  Poland

Poland  Georgia

Georgia  Kazakhstan

Kazakhstan  Cyprus

Cyprus  Azerbaijan

Azerbaijan  Moldova

Moldova